Top 8 International Money Transfer Sites Compared including Bitcoin

- GoldenGooseGuy

- Sep 25, 2019

- 7 min read

Updated: Oct 5, 2024

Cover photo: Belle visually demonstrates what happens to our money when we try to move it internationally with expensive services. Somebody with a giant scissors is taking a cut.

I hate hidden fees. So when I first tried to move money from the US to England to pay our bills as an international couple, I found it frustrating that some of these international money transfer services tried to hide them.

Why are they so sneaky? In short, because they know most people aren’t finance professionals, so they make extra money with an information advantage. However, because I work in finance, I’m going to show you exactly what they are trying to hide.

A Real Life Money Transfer Problem - Paying Rent

Here’s a real life international money transfer problem we experienced between the US and UK. While Belle and I were house hunting in England, the agents who listed our favorite house called to tell her that we were chosen from eight people who applied on the first day. This was our second application after an unexpected twist in our first one that nearly caused us to move our wedding date (if you haven't already, see my article, "Ever Wanted to Live Abroad? Moving to the UK - The Complete Survival Guide").

She was ecstatic, and being six hours ahead on Greenwich time, could barely wait until I woke up to tell me the news over a video chat in the morning. Now that we won the rental, we needed to pay the fees and first month's rent and deposit from a bank transfer.

Here's the breakdown of our initial rent expenses in the UK in pounds, which you should definitely factor in if you ever decide to live abroad (this includes VAT):

Application Fees: £406

First Month Rent: £1,000

Deposit: £1,500 (1.5x first month's rent)

Total: £2,906

This was over $3,900 in US dollars at the time! We needed to find a way to pay our rent and these fees as an international couple, quickly, or they might give our listing to someone else.

Although Belle's contribution was in a UK bank account, mine was in the US. Up until our first month of rent, we had used PayPal for some smaller transfers because I'd read somewhere on an internet forum that it was one of the lowest international money transfers with a low fee. As it turns out, that was completely wrong!

If Belle pays our UK landlord from her UK bank, it costs her nothing to make the transfer because her money is already in pounds. Pounds are worth more than US dollars, so it only takes about £800 to equal $1000 and what you see is what you get, because nobody else has gotten their hands on it. It’s a different story when I try to move my money from the US.

What seems easiest is to pay from my US bank to the UK landlord using a wire transfer, but in the comparison you'll see below, my bank charges me fees which force me to send $1038 to move $1000, while they pocket the difference of $38. Now I’m already down $38 compared to Belle’s UK bank transfer. Even though I've paid in more, I end up with the same amount in the UK landlord’s account, so I've lost money to the US bank's 'toll bridge operators'.

Where International Money Transfer Fees Can Hide

There are two places where fees can lurk when moving money between countries:

1. Transaction fee

2. Exchange rates fee

However, they only have to tell you about the transaction fee. The exchange rate has the cost embedded, so they are playing a shell game where they quote rates worse than market rates, sell back to the market at better rates for a profit, and skim the difference for themselves. We will see how this plays out in our rental deposit scenario, using today's rates.

Here’s a full comparison of 8 different ways to send transfers from a US to a UK bank account in dollars, as of 2 pm GMT on September 14th for USD to GBP. To keep the math easy, I used a $100 transfer and either grabbed these values from live pricing on their websites, created an order, or signed up for an account to get a quote.

I researched my home bank, Western Union, Moneygram, Paypal, Coinbase (using Bitcoin), Xoom, OFX, and Wise.

Transfer Comparison of $100 US Dollars to British Pounds

*Transferwise has rebranded as Wise

And the Winner Is?

This is the reason why I've been using them for the past 17 months. They are the only platform I know of that offer the market exchange rates with no mark-ups (what you'd get if you were a bank), regardless of the size of the transaction. Since I've started using them, they've not only consistently given me the best rates, which I've verified using trading platforms at my workplace, but they transfer quickly, with zero issues.

Choosing them was the result of a ton of research to find out who was highly recommended, reliable, and had the best rates. All comparisons pointed to Wise thanks to their transparency model of publishing fees. How do they accomplish this so cheaply? By using a trading principle where they match up people wanting to do opposite transfers. These trade matches have gotten faster over time as more people adopt the platform.

I've sent 21 transfers with them so far, and they've only gotten faster in the last year, now averaging about an hour for each one. I looked through the 21 email confirmations and they have always transferred same day, or the next business day if it's a weekend.

After requesting a transfer, I get an estimate from Wise which ranges from an hour to the next business day, so I give myself plenty of time to have the money ready to transfer the monthly rent.

They also offer to send money faster by using a wire transfer, credit card, or debit card, but the speed will cost you more, so I used only a bank account transfer (ACH) to keep the fees at a minimum and use a level playing field for the comparison.

I ran another comparison using $10K, and guess who ended up on top? Wise again. At $10K we can ignore Bitcoin at a whopping $798 in fees, and expensive Western Union, which can only send $2K maximum. The difference between choosing #1 ranked Wise ($110.21), and #2 ranked Xoom ($167.09), is an astonishing $56.88 cheaper to use Wise to move the same $10K amount of dollars. This is because Wise scales its fee down for larger transfers.

Keep in mind large amounts can result in a longer settlement time at the bank because it goes through an additional clearing process.

You can easily find the market rates, if you’re curious. Just search Google for the currency conversion you want to make, and they’ll give you the current market rate. Plug in the rates that your money transfer company quotes you, and see for yourself. You can also find historical market rates on Oanda.

Can't I Just Use Bitcoin?

I added Bitcoin because I knew some clever person out there is asking, "Can’t I just use Bitcoin?" I like your creativity, but the technology just hasn’t arrived yet. Unless you’re paying your bills in Bitcoin (unlikely!), fees will be higher because Bitcoin is its own currency, so your transaction and exchange rate fees are doubled, you are exposed to rate changes while holding Bitcoin, and unlike a bank, there is little protection if something goes wrong. Like all new technologies in their infancy, Bitcoin is an expensive and impractical toy for crypto nerds and early adopters until it becomes efficient enough to compete with these services.

Before we make any decisions, and because this is The Golden Goose Guide, we not only focus on how much we can save (Golden Milestone #2), we stay financially secure (Golden Milestone #5). Any time you are moving money, you have to consider both. Financial security for international money transfers falls under two areas - transfer protection and online banking security.

Transfer Protection

For very large amounts of money (more than $10K), if you can’t move it in smaller chunks, you'll want to consider using something with additional legal protections, like a bank or currency broker. Also, keep in mind that moving large amounts of money to another country can result in filing obligations (FBAR for over $10K if you’re from the US). This is partly why I kept banking in the US; to maintain my US credit, while keeping transfers, costs, and red tape to a minimum.

Online Banking Security

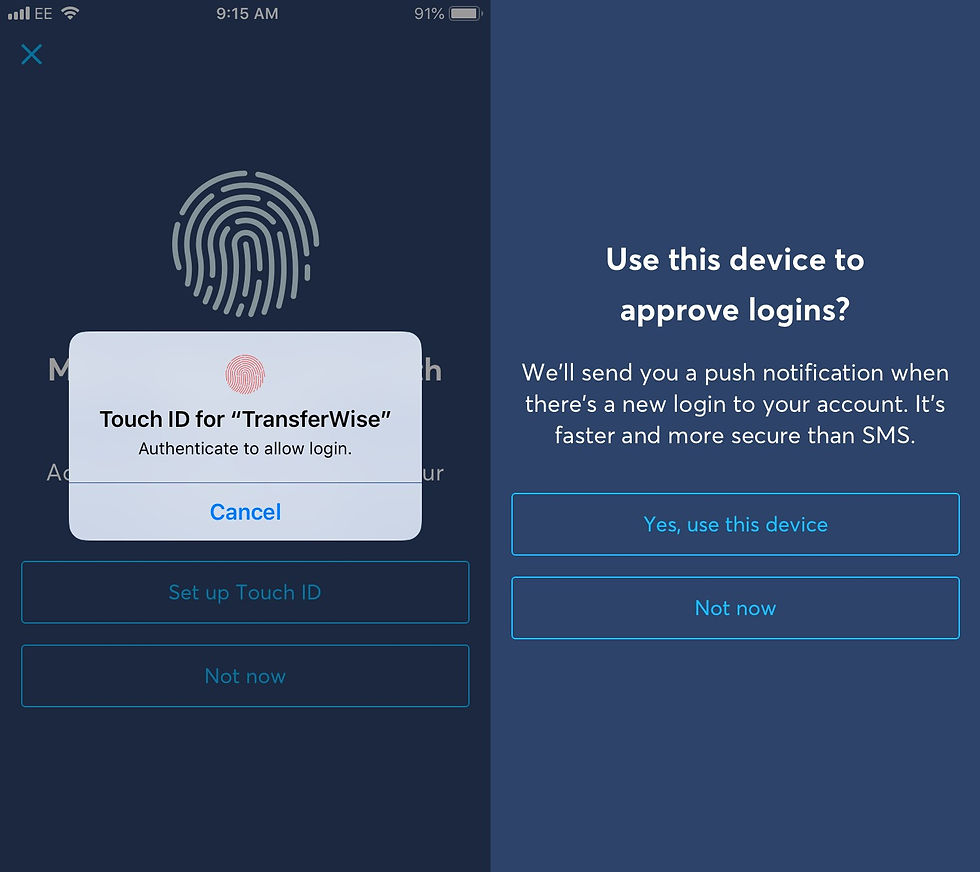

Now that we’ve shown that Wise is the best deal, we want to also make sure it’s secure. It’s easy to set this up. Just download the app for your phone and enable the biometric login, then go to the website and use “approvals from the app.” Now you’ll be notified of any transfer in real-time via the app. It's probably safer than how your own bank currently handles transfers.

If you'd like to try it out, Wise lists their prices on their website very clearly. You don't even need a login to compare their rates. My advice is to set up your first transfer early, so you can verify everything is set up properly before any due dates.

If you enjoyed this article, please subscribe and leave your thoughts in the comments below. You're invited to join our Golden Goose Guide community and ask questions in the Forums using the Wix App

-Golden Goose Guy

Next Article #14: House Sitting at a Magnificent English Estate

Previous Article #12: 10 Easy Ways to Save Money on Your Grocery Bill

Note: This post uses affiliate links, which means we earn a small commission (even though it costs you nothing more). This helps us pay for hosting fees, email lists, and other running costs of the website.

Comments